Today’s Middle East and tomorrow’s opportunities

While the Middle East and Africa certainly face a number of challenges, the mood at this year’s MEADFA Conference in Dubai was far from gloomy. As MEADFA President Haitham Al Majali, welcomed around 500 delegates to the 16th edition of the event he said that while the postponement of the conference had caused disruption and inconvenience, he was delighted that so many people had found time to attend. He continued that while much had happened in the region over the past year, there is considerable positive sentiment across the business.

Growth in the Middle East, according to data from Generation Research for the first half of 2017, stands at 0.8%. While this is a slower rate than in some regions Al Majali was hopeful that this year would see more progress. The picture in Africa was less positive as sales had declined by 3.5%, but again he was confident about the future and said the potential in this continent is enormous.

Colm McLoughlin, Executive Vice Chairman & CEO, Dubai Duty Free, marking his 49th year in duty free, shared a selection of impressive figures. MEADFA opened with just nine members, but now there are 35. As an example of the success of the region, he cited the fact that sales at Dubai Duty Free are now just short of $US 2 billion, and the company sees 75,000 transactions every day.

Dubai Duty Free Chief Operating Officer Ramesh Cidambi continued the theme, and said that in a “fantastic” year, the demographic profile of the airport’s passengers was one reason for his company’s success. Serving more than 100 destinations, the business is broad, while the reappearance of Chinese customers, who represent 4 or 5% of passengers but 12% of business, as well the return of Russian travellers, also helped boost sales. While high street retailers are suffering from a decline in footfall, this is not the case for his business, as 90 million people will go through Dubai airport this year. There is a threat to be faced, in the form of leading online players such as Alibaba, and the duty free travel retail industry must work together with brand partners to better engage with customers to meet this challenge.

Oman Airport Management Company Non-Aeronautical Senior Manager Faisal Sultan Salim Al Mamari revealed ambitious plans for the future of his business. While aeronautical revenue was expected to rise by 50%, he predicts a 100% increase for non-aeronautical revenue. With the opening of a new terminal at Oman, the duty free area will be increased by more than 100%, while food and beverage facilities will be expanded by over 80%.

One of Dubai Eye’s leading commentators Richard Dean, Presenter of Business Breakfast, a daily radio talk show and podcast, outlined the five stories we can’t ignore in 2018. The first is money, and when it comes to the financial climate, the glass was, he said half full not half empty. One reason for this was the fact that oil had topped a $70 dollar price point for the first time in three years. The naming of Morhammed bin Salman crown prince in Saudi Arabia had paved the way for a number of reforms including women being allowed to drive and more women going to work, prompting a rise in sales of cosmetics. The third key story is the consumer. The middle eastern consumer is young, but optimism among young Arab people is waning. Technology was next on Dean’s list. Considerable development is happening in the tech space, but the region is still quite far behind international bench-marks when it comes to investment in the sector. Lastly culture was, he said not always considered a business story. Dean believes however that it is. Arab influence remains important to the region.

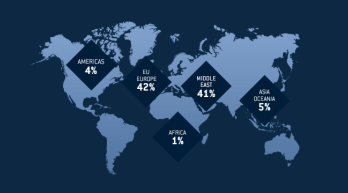

Counter Intelligence Retail Research Director Stephen Hillam shared the findings of a new study into the Middle Eastern market. Passenger numbers have risen from 104 million people leaving the Middle East in 2014 to 132 million in 2016, and this figure is expected to reach 161 million in 2020 he said. The drivers for this growth include the opening of new routes, increased capacity and the launch of new airlines. Looking at the Middle Eastern passenger, 55% are millennials, 73% male and 81% are travelling for leisure. Staff, differentiation and promotional activity are the three core areas for influencing shopper behaviour.

Inati Ntshanga, aviation consultant and former CEO of South African Express, explored the current climate in African aviation. Historically aviation had not been critical in the region, but now there is what he described as a willingness to “open the African sky”. There are now about 254 airlines, and the continent is expecting passenger growth of 8% in 2018, an increase from 7.5% in 2017. The number of African middle class now stands at 425 million, and this is set to rise to 1.1 billion in 2060. Now is, he said, “the time for Africa”.

The final session of the day shone a spotlight on innovation and initiatives that are creating excitement in the regional duty free and travel retail industry. Tarkan Demirbas of Philip Morris International told the audience that PMI’s vision is for smoke free products to replace cigarettes as soon as possible. Since 2008, PMI has invested more than US$ 3 billion in research and development on the programme.

The new, app-led pre-order service soon to be launched by Beirut Duty Free in partnership with Inflyter was showcased by Wassim Saadé and Amir Abbaszadeh, who offered an intriguing glimpse of the future in duty free shopping. They explained how the new tool aims to capture the imagination of connected travellers, and prompt them to purchase using mobile channels.

A ground-breaking campaign from Dufry, supporting the United Nation’s sustainability goals, was detailed by the company’s External Affairs Director Sarah Branquinho. The campaign, launched by the UN in 2016, has the aim to reach a population of 2 billion. In 2018, it will evolve to encourage people to take simple actions that will help change the world.

A compelling day two of the conference began with a closer look at the financial prospects for the region. Samir Sweida-Metwally and Gary McFarlane of Emerging Markets Intelligence & Research explored how global geopolitical and economic trends would impact the Middle East. Consumer confidence will return as oil prices rise and the dollar depreciates. However, in the medium term, the security situation will continue threaten trade. Brands that focus on client loyalty will benefit from the avoidance of down-trading.

A similarly optimistic picture was painted by Olivier Jager, Co-founder & CEO of travel industry analyst ForwardKeys. He shared new research, which showed that destinations in Africa had benefitted from a resurgence of tourism. Passenger numbers were up by 29% in Tunisia following recovery after recent terrorism attacks, and a healthy 21% in Uganda. The Middle East had experienced “robust arrival growth for all except Qatar” with Kuwait and Oman leading the field with increases of 22 and 21% respectively. Looking at transfer passenger numbers, Doha witnessed “a sharp decrease of 13% after the crisis”, while Istanbul and Dubai have seen growth.

Moving on to the airline perspective Sales Group Europe President Karen Durban-Villeval said that the main challenges facing her business were airport sales, online discounts and ultra connected passengers. Creating a clear identity and positioning for the airline offer and maintaining the traditional ranges while introducing inspiring now ones were among the levers to sales in the African market. Inati Ntshanga, African aviation consultant and former CEO of SA Express Airways, noted that “cabin crew still see themselves as primarily as safety officers not sales people”, and that considerable room for improvement in inflight sales exists among African carriers.

During the next session, Sarah Branquinho, in her role as President of ETRC, outlined progress made in combatting three challenges currently confronting the industry. When it comes to sales of tobacco, the industry has faced many challenges over the years. However she described the implications contained within the World Health Organization’s Illicit Trade Protocol as “a really big one that could affect the viability of duty free tobacco sales globally”. She also detailed technological responses to increasing legislation on product labelling, and plans to tackle carry-on baggage restrictions. As an example of the severity of the problem, MEADFA Vice President and Aer Rianta International Middle East CEO Nuno Amaral said that he was working with airports to make them aware of the potential damage to revenue, but that it was “like pushing water up hill”.

Dubai Duty Free Senior Vice President, Finance Bernard Creed said the industry faced a number of challenges from the introduction of VAT and excise tax in some GCC states. His advice to those companies likely to be affected was to prepare early, hire a tax expert, set up an implementation team and organise an advisory board, keeping in mind the penalties for any companies not complying with the new rules. The whole concept of duty-free in the region was, he said, in danger of being “eroded” by the legislation.

In a lively end to the day, Victor Kgomoeswana, broadcaster, branding and business expert, described his own personal experience of growing up in rural Africa, where brands were an alluring status symbol. Africans value quality that delivers, and (even if temporarily) nonAfrica brands currently dominate the market. It is essential, he said, to avoid exploitation and indifference to the needs of the African consumer. But his uplifting final thought was that “Africa is open for business.”